The Only Guide for Lahore Smart City

Table of ContentsThe Best Strategy To Use For Lahore Smart CityThe smart Trick of Lahore Smart City That Nobody is Talking AboutSee This Report on Lahore Smart CityRumored Buzz on Lahore Smart CityOur Lahore Smart City DiariesExcitement About Lahore Smart City

If rental fees typically increase 3% to 5% a year, your earnings should rise, too. "After two decades, that's a rather powerful rental return," Meyer claims. "Which does not consist of appreciation." Rental homeowner can apply for, yet with really essential distinctions. For one, the down repayment is normally much larger.:max_bytes(150000):strip_icc()/real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)

A lot of property investors require or desire a mortgage. Before you apply, make certain you have actually finished your spending plan, researched just how to attract tenants and also have a clear concept of residential property administration prices. Lenders often tend to offer the most effective rates to customers with. "Could you get a financial investment residential property loan if your rating was 680 or 700? Possibly, however you would certainly simply pay even more in interest," Meyer says.

Fascination About Lahore Smart City

In 2022, as rate of interest rates rise, the technique of buying a run-down home, repairing it up, increasing the rent then obtaining against that home to get one more is obtaining much more challenging, Meyer states. Lenders want assurances the home loan will be paid in difficult times and also will certainly scrutinize your property very closely before granting a 2nd car loan.

"Since they're not mosting likely to be able to re-finance and take equity out as well as have that building still be cash-flow positive if rates are twice as high as they were a year and also a half ago.".

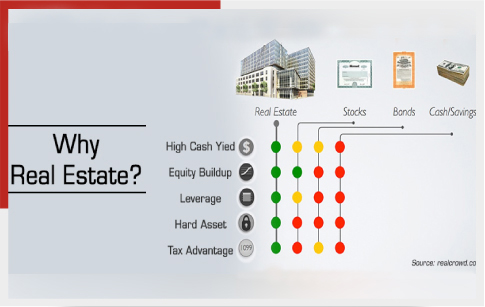

Realty residential property is a property class that plays a substantial function in several financial investment profiles as well as is an eye-catching resource of present income. Investor appropriations to public as well as personal realty have enhanced dramatically over the last two decades. As a result of the unique qualities of realty residential or commercial property, property investments have a tendency to act differently from other asset classessuch as stocks, bonds, and commoditiesand hence have various risks and diversification benefits.

Fascination About Lahore Smart City

A handful of effective investor concur that home loan rate of interest aren't too expensive. Obviously, they're greater than what we saw in 2014, but that was a distinct scenario. As opposed to allowing market conditions determine how you invest, concentrate on what you can manage. A handful of successful genuine estate capitalists concur: Stop waiting for rate of interest to decrease prior to purchasing a rental residential or commercial property or purchasing a key residence.

In the grand system of points, today's rates are "not that high," emphasized Massachusetts-based real estate investor and also expert Dana Bull. While that might seem exceptionally high compared to what we saw last year, Bull urges financiers to remember that, "we had it actually, truly great for the previous couple of years.

Here's what Bull as well as three other effective actual estate financiers advise heading right into 2023. Expert confirmed each financier's home ownership and rental earnings claims.

Some Known Factual Statements About Lahore Smart City

Rather, figure out exactly how you can attain your investing goals among whatever the existing financial look at this website situation is."It's still essential to be mindful of what's going on in the market, she kept in mind: "You don't want to go into things blindly, yet you also don't desire to be paralyzed based on what can or may not happen."For instance, a variable that individuals are obsessed on right currently is the ordinary mortgage price.

It's the same for real estate, a New Hampshire-based financier that owns 137 rentals informed Insider: "At the end of the day, time in the market will certainly always beat timing the market."Matt, who passes "The Lumberjack Property manager" for privacy factors, has actually been developing his rental profile given that the very early 2000s.

The smart Trick of Lahore Smart City That Nobody is Talking About

He doesn't necessarily mind the rising home loan rates, as long as his return on capital the revenue he might possibly gain from his real-estate holdings after considering costs is what he takes into consideration to be "wonderful," he said."To recognize what a lot is, you need to understand what every other bargain is," he discussed.

Some Of Lahore Smart City

As a prospective buyer, you want to consider your duration: Are you looking to remain in your home for the following 5 to 10 years? Or do you assume you'll make a relocation within 2 to three years? If you're intending on purchasing and potentially marketing within three years or much less, you probably desire to wait to purchase, said Mejia: "Worths go up and down, up and also down, up and down.

You don't wish to place yourself in a placement where you might shed money."It'll be more secure to buy if you're intending on remaining put for a while. Your residence will certainly have more time to value in value, which will aid balance out pricey transaction expenses that feature acquiring, like your representative's compensation and also closing costs.

I think it's a psychological difficulty that people need to obtain over today," stated Mejia. "If you can still manage a home loan settlement in your present market and also acquire a home that you would such as, after that it definitely still makes sense to get." from this source Mike and also Olivia Zuber retired in their 40s, thanks to smart property investing.